Many debt collection agencies still rely on manual dialing or outdated IVRs, a model that often results in low contact rates, high agent burnout, and growing compliance risk.

But what if you could deploy AI voice agents that handle Tier‑1 calls at scale, while ensuring every conversation stays FDCPA, TCPA, and CFPB compliant?

In this short guide, we’ll give you a high-level look at how AI voice agents can be set up for debt collection. We’ll cover the essentials: connecting with your existing SIP trunk or dialer, creating natural-sounding AI prompts, and setting up campaigns. Finally, we’ll touch on how to track performance with AI-powered insights so you can refine strategies and steadily improve recovery rates.

Step 1: Define Tier‑1 workflows & use cases

The first step to successfully deploying AI voice agents in debt collection isn’t about technology, it’s about strategy. Start by mapping out the Tier‑1 workflows your agents will handle: high‑volume, rule‑based tasks that don’t require deep human negotiation but still demand consistency and compliance.

Typical Tier‑1 use cases include:

Payment reminders: reminding account holders about upcoming or overdue payments. This keeps contact rates high and recovery timelines short.

Verification & right‑party contact (RPC) checks: confirming customer details like phone numbers or addresses, helping you maintain compliance and accurate databases.

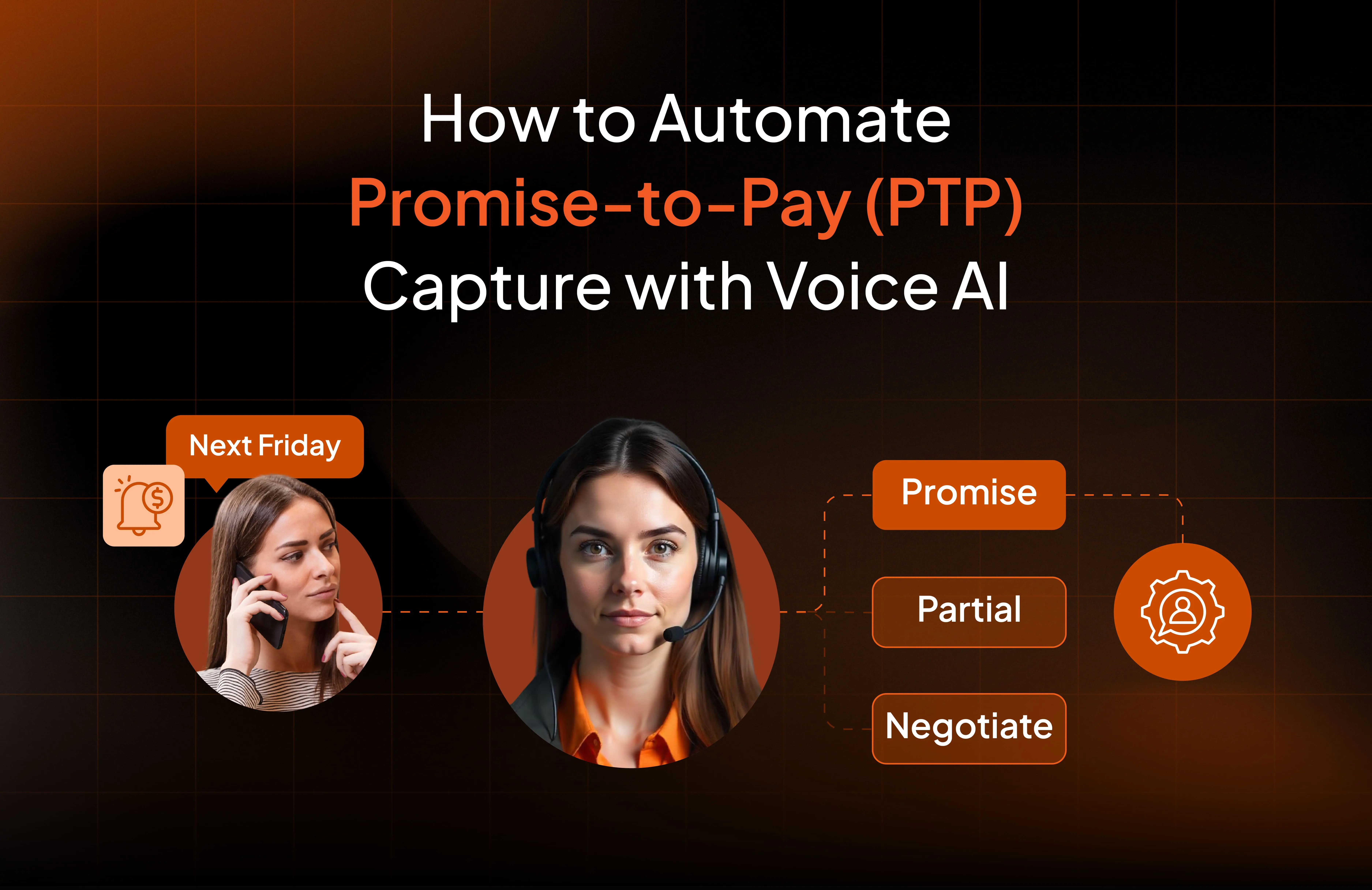

Promise‑to‑pay capture: gathering verbal commitments and logging intent directly into your CRM, so human agents can follow up only where needed.

Follow‑up scheduling & call‑backs: automatically arranging future contact times based on customer availability.

By clearly defining these Tier‑1 tasks, you set your AI voice agents up to do what they do best: handle repetitive outreach at scale, reduce manual dialing, and ensure your live agents spend time only on complex or sensitive cases like disputes, escalations, or hardship calls.

Connecting to your dialer or SIP trunk

Once you’ve defined your use cases, you need to operationalize them. AI voice agents don’t dial numbers by themselves, they require a dialer integration or SIP trunk connection.

“You'll need to connect your AI agent to your dialer or SIP trunk, Vodex works with most existing providers.”

SIP trunks act as digital pipelines that carry your calls over the internet, letting AI voice agents reach customers reliably. Keeping your existing SIP trunk means you don’t have to rebuild your entire call infrastructure, you simply plug the AI agent into what’s already working.

Key benefit: This approach lowers setup costs, keeps your current compliance controls intact, and makes AI activation faster.

Step 2: Stay compliant with FDCPA, TCPA & CFPB

Adopting AI voice agents doesn’t mean you can ignore compliance. in fact, automation makes it even more critical to get it right from the start. Here’s a quick primer on the three main U.S. regulations every debt collection agency should keep in mind:

FDCPA (Fair Debt Collection Practices Act):

Protects consumers against unfair, abusive, or deceptive collection practices. Requires clear disclosures (like identifying your agency), limits on calling times, and prohibits harassment.

TCPA (Telephone Consumer Protection Act):

Regulates outbound calls, especially auto‑dialed calls and prerecorded messages. Requires prior express consent, opt‑out handling, and careful management of calling lists.

CFPB (Consumer Financial Protection Bureau):

Sets broader guidelines on fair servicing, complaint handling, and oversight of digital communications, including voice AI.

How AI voice agents help you stay compliant

Modern AI voice agents (like Vodex) aren’t just about speed or scale, they’re designed to embed compliance into every single conversation, automatically and consistently:

- Dynamic disclaimers: Instead of relying on human agents to remember scripts, AI agents always open calls with required FDCPA disclosures like “This is an attempt to collect a debt.” You can also customize disclaimers by campaign type or jurisdiction.

- Consistent call limits: AI voice agents can enforce daily or weekly contact limits, respecting CFPB’s “7‑in‑7” rule or other agency policies, something that’s harder to track manually.

- Detailed audit trails: Every call is logged with timestamp, script version used, consent status, and outcome. These records make responding to audits or consumer complaints much faster and more defensible.

- Custom rules by campaign or region: Since compliance requirements differ by state or by type of debt, AI agents can apply campaign‑specific logic, like different disclaimers or contact rules at scale.

By shifting these tasks from memory‑based human processes to automated, rules‑driven systems, AI voice agents help debt collection agencies stay confidently within FDCPA, TCPA, and CFPB guidelines, even as call volumes grow.

We’ll cover setup checklists and audit reporting tips in our upcoming compliance guide.

Step 3: Intro to prompting: AI call scripts

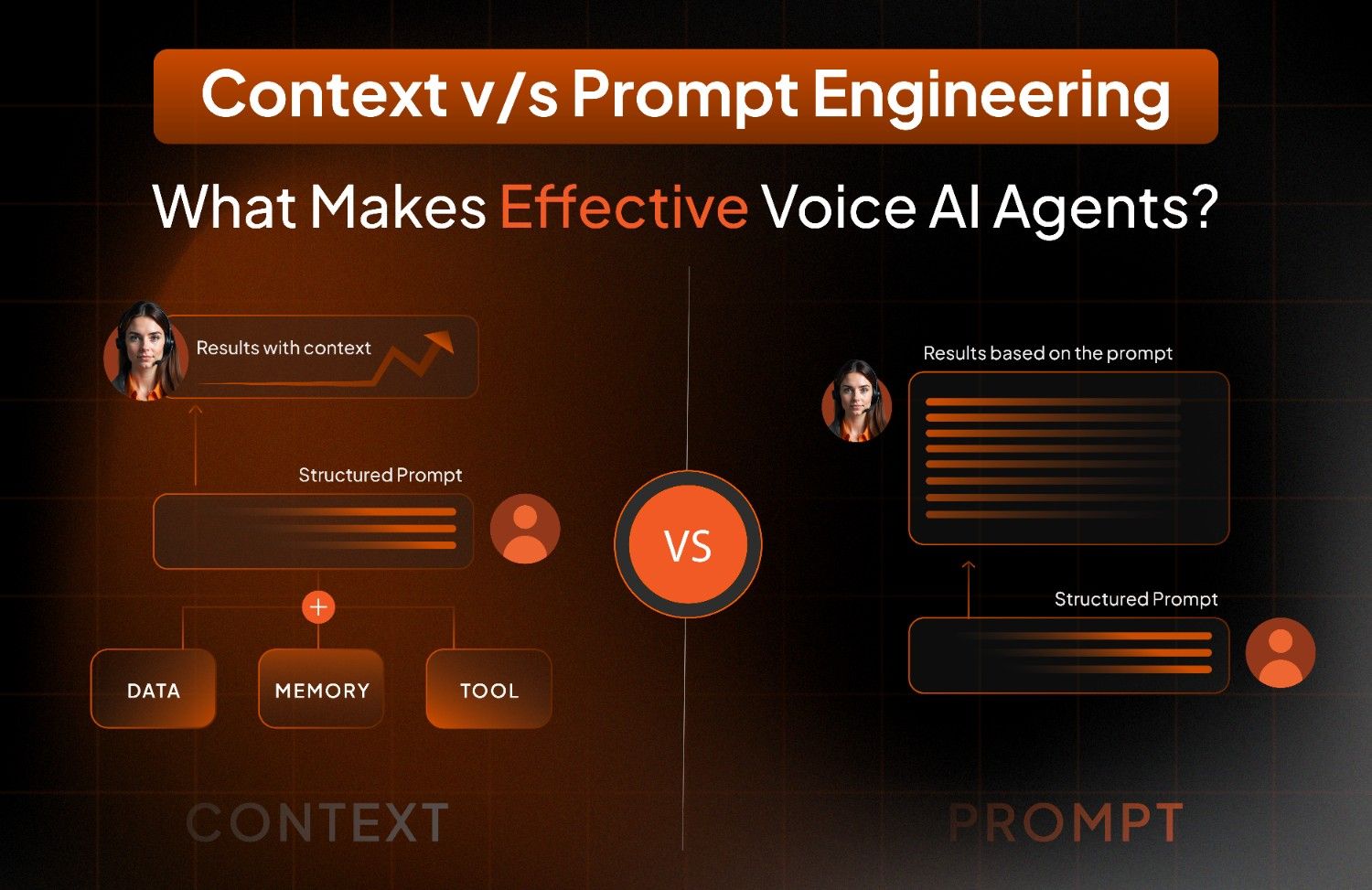

Setting up an AI voice agent isn’t the same as giving a human a rigid, word‑for‑word script. Instead, you’re designing prompts, structured instructions that guide the AI on how to handle conversations dynamically.

Why prompting matters

AI agents don’t think in “if this, then that” trees alone. They work better when given context: the business goal, tone, fallback rules, and what to do when someone objects, asks a question, or raises a dispute.

Unlike static scripts, prompts let the AI keep conversations natural, polite, and responsive while still steering toward the target outcome (e.g., payment promise, verification, or escalation).

What a good prompt includes

Call objective: e.g., confirm right‑party contact and arrange payment.

Tone & style: calm, professional, not pushy.

Core flow: greeting, verification, payment discussion, closing.

Objection handling: what to do if the customer disputes or is busy.

Compliance reminders: required disclaimers or opt‑out instructions.

Escalation triggers: transfer to a human if certain keywords or emotions appear.

This design makes the AI agent feel less robotic and keeps calls on track even if customers say unexpected things.

Example: simple prompting snippet

Here’s a mini example (actual prompts will be longer and more contexual):

“You are a polite AI voice agent for a debt collection agency.

Always open with: ‘This call is an attempt to collect a debt.’

Confirm name, verify DOB.

If payment disputed → escalate to human agent.

If customer asks about balance → share {amount}.

If customer requests no further calls → log opt‑out immediately.”

This isn’t just “read this text” it’s giving the AI guidelines to navigate real conversations.

And remember: the richer your prompts, the more human‑like (and compliant) your AI agents sound.

Step 4: Build, test & refine your AI voice campaigns

With your Tier‑1 workflows mapped, compliance guardrails in place, and prompts ready, it’s time to bring your AI voice agent into the real world.

The power of voice AI isn’t just in going big, it’s in going smart.

Start where it makes the most impact:

Instead of launching full scale immediately, you can choose to pilot your agent on a specific campaign or customer segment. For example:

– Overdue accounts in the 31–60 day bucket

– Reminder calls two days before due date

– Simple verification calls to update contact details

This helps you quickly measure how AI performs, see real‑world objections, and fine‑tune before wider rollout.

Practical build & launch steps:

– Connect your AI agent to your existing dialer or SIP trunk (Vodex integrates with most major providers)

– Define fallback logic: when should the AI try again, leave a voicemail, or escalate to a human agent?

– Set up escalation rules: e.g., customer disputes debt → transfer to trained collector

– Test with a limited call volume first to see response patterns

Refine based on real data, not gut feel:

Here’s where Vodex’s platform can help you go beyond static dashboards.

With AI-powered campaign insights, you can ask your campaign data questions in plain language:

– “How many customers promised to pay last week?”

– “How many escalations happened yesterday?”

– “Which prompt led to more successful payment plan agreements?”

By analyzing these insights, you can identify exactly where to tweak your prompts, escalation thresholds, or outreach timing, making your agent smarter and your contact strategy sharper.

Design matters: keep the customer experience human‑like

Plan for:

– Clear, empathetic opening lines

– Natural confirmation and verification steps

– Graceful handling of “I’m busy” or “I need more info” objections

– A smooth transfer to a human agent when needed

Step 5: Track, learn & scale intelligently

Once your AI voice agent is live, the real power comes from what you learn and how you adapt.

Instead of just counting dials or minutes used, modern receivables teams track metrics that directly tie to success:

Right‑party contact (RPC) rate: connections vs. attempts

Promise‑to‑pay (PTP) rate: How many contacts commit to a payment date or plan

Escalation rate: How often AI hands off to human collectors

Opt‑out / Do‑Not‑Call requests: For compliance health

From raw data to real answers:

Traditional dashboards often leave you staring at numbers without context.

That’s why Vodex offers Ask AI / campaign insights, so your ops team or even non‑technical users can type plain questions like:

– “How many contacts requested a callback yesterday?”

– “Which campaign had the highest PTP rate last week?”

– “How many SMS reminders were sent in June?”

And get instant, conversational answers pulled directly from live campaign data, instead of waiting for next month’s report.

This intuitive interface means even team members without analytics training can explore, ask, and discover actionable insights helping you improve, scale, and optimize faster.

Why this matters:

Data‑led scaling isn’t just about growing volume, it’s about growing smart:

– Doubling down on campaigns that show higher PTP

– Refining prompts where contact rates lag

– Adjusting call times or segments for better RPC

By continuously tracking and asking the right questions, your voice AI operation stays agile, adapting daily instead of quarterly.

Quick recap:

Start by defining your highest‑impact Tier‑1 workflows (like reminders or PTP calls). Build compliance in from day one. Move beyond static scripts by designing AI prompts with context. Launch thoughtfully, then track, learn, and scale using real‑time insights like Ask AI.

Learn more about how Voice AI agents can be used for payment reminders

Ready to take the next step?

If you’re curious to see how Voice AI actually works in a collections environment, whether it’s handling reminders, PTP follow-ups, or inbound inquiries. We’d be glad to walk you through it. No jargon, no generic demos, just a real look at how it can fit into your firm’s workflows.

Whether you’re exploring new compliance-friendly tools, looking to improve right-party contact rates, or simply want to hear the agent in action, you can set up a quick conversation with our team.

.jpg)

.png)

%20(4).webp)

.png)

-min.png)