Balancing empathy with efficiency, personal relationships with scale, and recovery with reputation, it’s a high-wire act that becomes harder to maintain as portfolios grow. Legacy tools and workflows, while once effective, now struggle to meet the expectations of borrowers and the operational needs of lenders.

What’s needed isn’t just another auto-dialer or CRM plug-in. It’s a fundamental rethink of how collections can be made more intelligent, more scalable, and more adaptive. That rethink is happening now, powered by AI.

The Hidden Frictions Undermining Collections

Much of what breaks down in collections isn’t a people problem, it’s a system problem.

Many BHPH dealers accept a certain failure rate as normal, not realizing how much of it is driven by backend issues like:

- Mismatches between the Dealer Management System (DMS) and payment gateways

- Technical failures in link generation or expired payment URLs

- Insurance or CPI confusion that adds to perceived balance discrepancies

- CRMs surfacing incorrect data about account status or next steps

These issues chip away at recovery rates silently. Human agents often don’t have visibility into these patterns, but AI does. By analyzing thousands of interactions, AI systems surface which obstacles are causing drop-offs and which ones are fixable.

The goal isn't just more automation. It's smarter, feedback-driven systems that help remove friction from the payment process entirely. Learn how AI is redefining debt collection for auto finance.

The Objection Behind the Objection

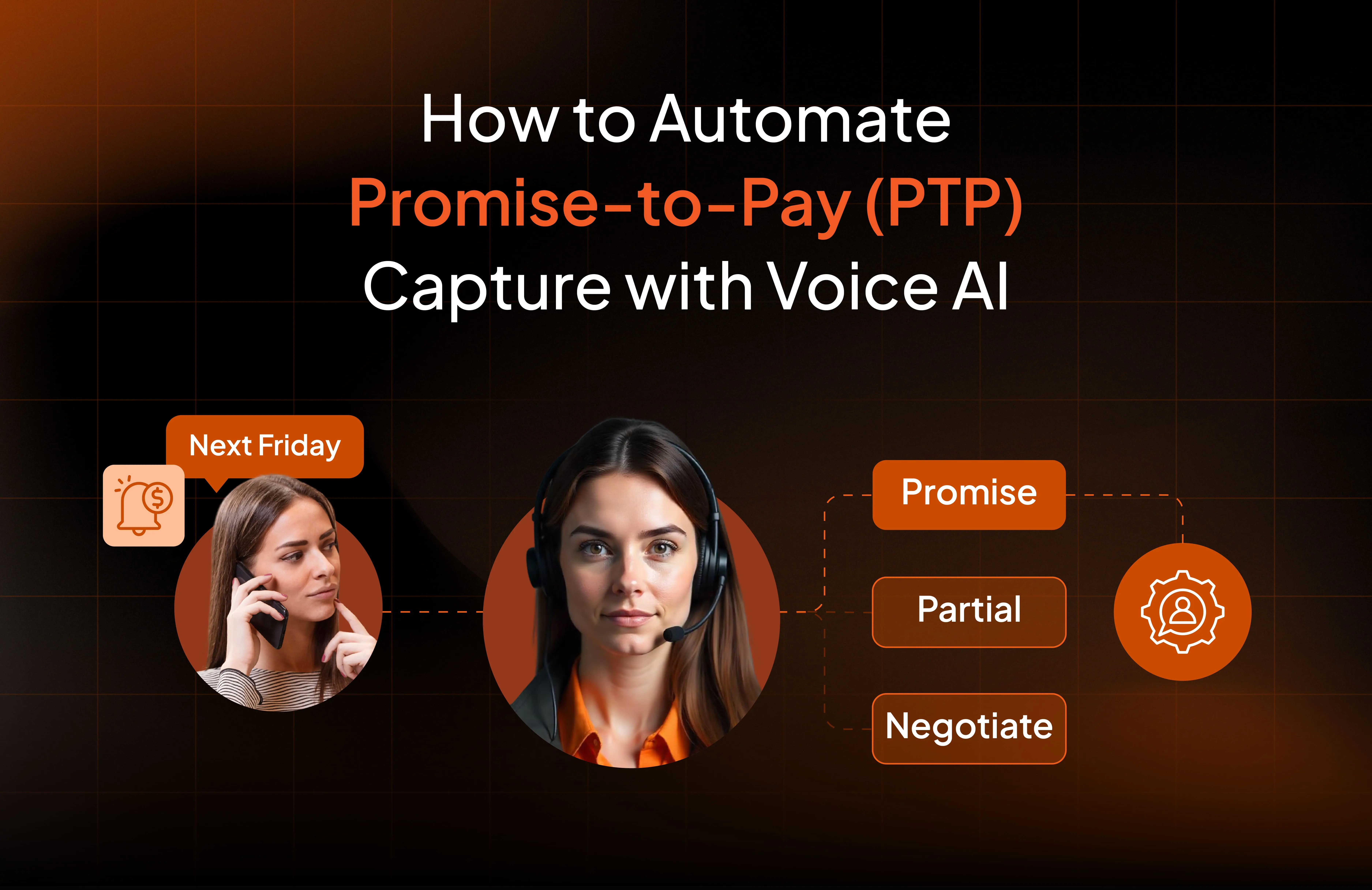

Collectors know the drill: "I can't pay right now." It’s the most common reason conversations stall. But this objection often masks a deeper issue, confusion, lack of clarity, failed prior attempts to pay, or simply needing more flexible options.

AI voice agents can probe gently without sounding scripted. By identifying intent and categorizing objection types, they can escalate intelligently, follow up more empathetically, and even adapt messaging based on previous interactions.

That matters because every failed conversation that ends with "I can't pay" is a missed opportunity, not necessarily due to unwillingness, but due to the system's inability to meet the borrower where they are.

Moving from Automation to Optimization

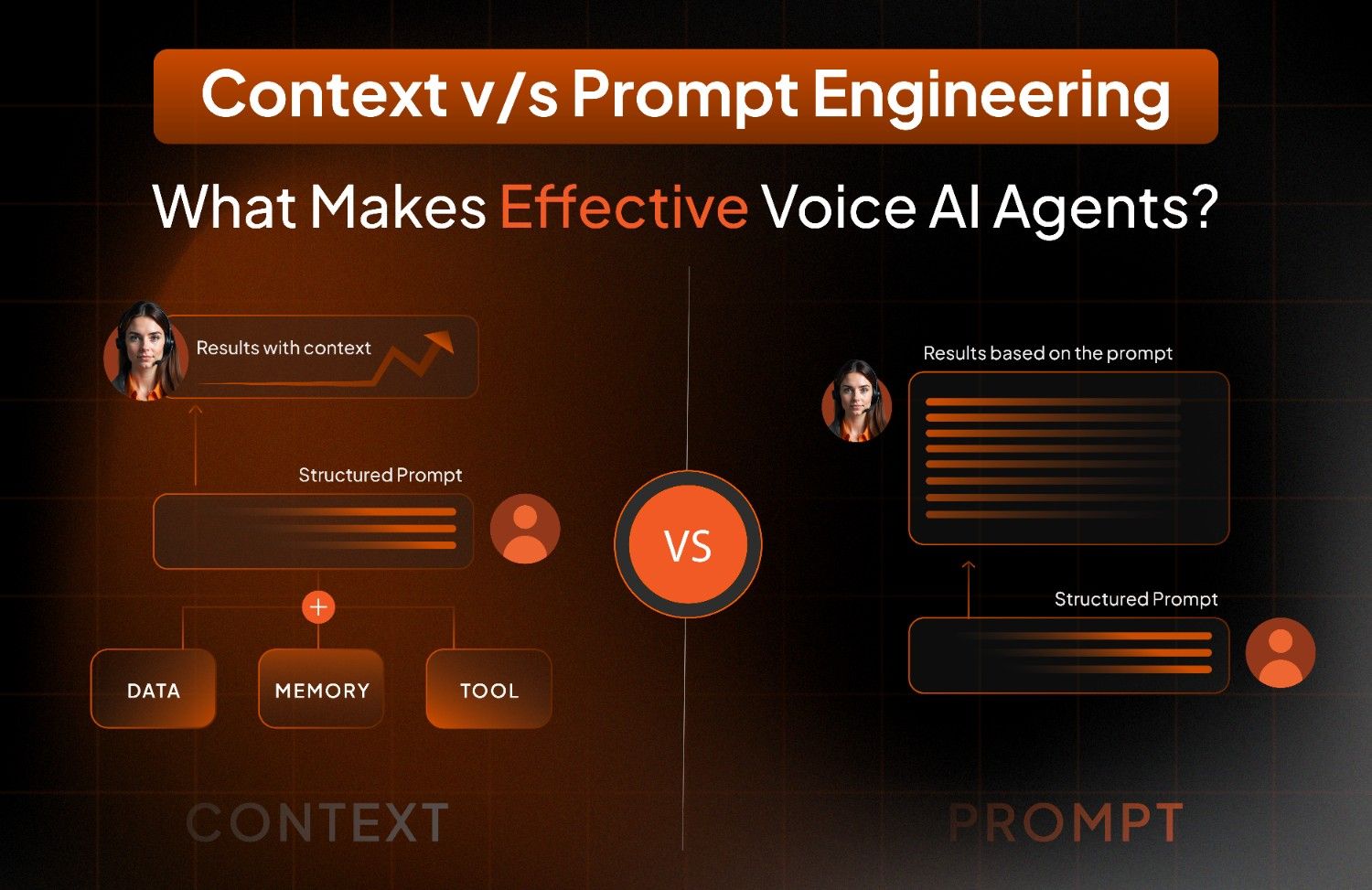

The current generation of AI agents handles routine tasks well. They send reminders, verify balances, offer links, and confirm receipt. But the future lies in what happens next:

- Dynamic adaptation based on live objections

- Sentiment analysis to prioritize escalations

- Campaign performance feedback in near real-time

- Context-aware next-best-action guidance

This shift turns AI from a call center automation tool into a strategy layer. It doesn't just follow rules, it helps improve them.

Faster Launch, Lower Lift

Contrary to perception, deploying AI doesn't require months of onboarding. Today’s platforms are pre-integrated with the most common DMS systems, payment gateways, CRMs, and telecom providers.

About 70–80% of conversations in BHPH collections follow repeatable paths. These can be configured with pre-trained templates in just a few hours, making it possible to go live quickly and cost-effectively.

The remaining 20%? That’s where the AI learns and evolves, powered by real conversations, contextual feedback, and performance data.

Early Mover Advantage Compounds Over Time

Every call an AI system handles becomes part of its learning cycle. The more calls, the better it segments accounts, adapts messaging, and improves payment outcomes. This creates a compounding effect that becomes a competitive moat.

Businesses waiting to adopt AI are not standing still, they’re falling behind. As others improve call outcomes, automate Tier-1 cases, and free up their human teams for more nuanced conversations, the performance gap only widens.

Compliance, Consistency, and Customer Trust

AI also brings consistency. It doesn’t miss disclosures, forget compliance language, or deviate from tone guidelines. Every call is logged, documented, and auditable, providing peace of mind in an increasingly regulated space.

Borrowers benefit too. They get faster, more accurate, and more respectful interactions. And they can resolve issues without needing to wait for a callback or reach the right rep.

AI Is Not a Shortcut. It’s an Infrastructure Shift.

AI in BHPH collections isn't just about working faster. It's about working smarter—building systems that learn, adapt, and scale alongside the business. It’s the difference between using automation to patch up leaks and using intelligence to reroute the entire workflow.

Collections isn’t going away. But the way we approach it is changing fast. The companies that treat AI as a core part of that change—not just a bolt-on feature—will lead the next decade of auto finance.

.png)

.jpg)

%20(4).webp)

.png)

-min.png)