Traditional methods, including manual outreach and fragmented backend workflows, are proving to be inadequate. Instead, what’s needed is a reimagining of the collections infrastructure. One that’s intelligent, adaptive, and future-ready.

That shift is happening now, powered by Voice AI.

The Emerging Challenges in BNPL Collections

The BNPL model has enjoyed explosive growth, largely due to its consumer-friendly promise of interest-free installment payments and a frictionless checkout experience. However, this very simplicity at the front end often masks a chaotic and inconsistent collections process on the backend. With the increase in adoption, cracks are beginning to show, especially when it comes to BNPL repayment defaults.

A LendingTree study found that 64% of Gen Z consumers have used BNPL services, and 41% of them reported missing at least one payment. Even more concerning is that over 70% of these users juggle multiple BNPL loans simultaneously. What we’re seeing isn’t just a financial burden but a psychological one: forgetfulness, unclear due dates, and platform overload all contribute to delinquencies. These aren’t just numbers, they’re warning signs of a systemic issue.

As repayment defaults rise, BNPL companies are finding themselves in uncharted territory. Unlike traditional lenders, many BNPL providers aren’t set up to handle the intensity and complexity of collection efforts. This has resulted in poor customer experiences, inefficiencies in recovery processes, and a mounting compliance risk.

Voice AI: A Paradigm Shift in BNPL Debt Collection

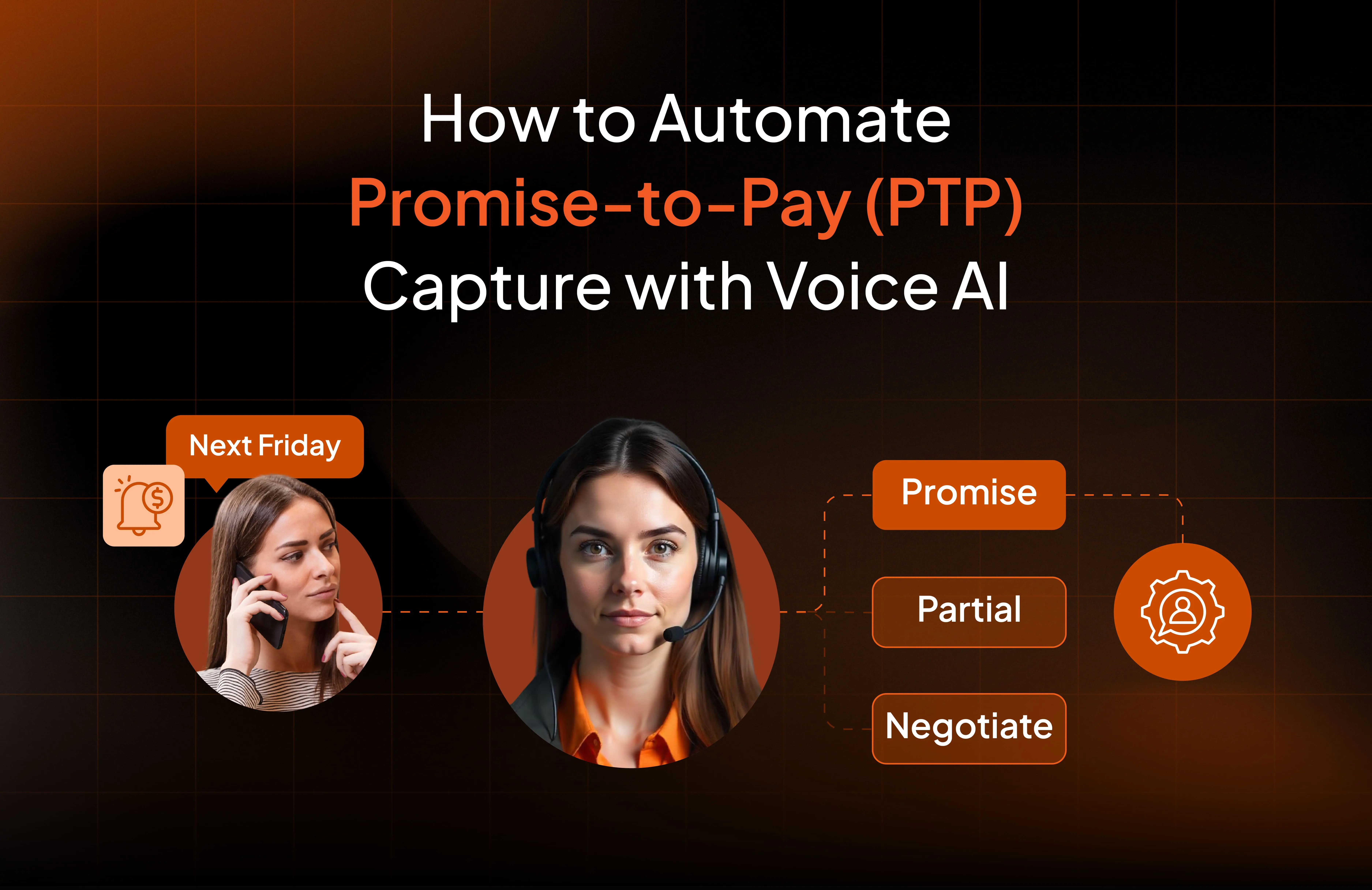

Voice AI offers a profound rethinking of what collections can be. It’s not about replacing humans, it’s about complementing them with intelligent systems that can scale operations, adapt to user behavior, and unlock insights and reduce manual effort. Here’s how Voice AI transforms BNPL collections:

1. Enhanced Compliance and Governance

Collections in the BNPL space are becoming more regulated, especially as financial authorities begin scrutinizing lending practices and recovery policies. The Consumer Financial Protection Bureau (CFPB) has called for stricter transparency and oversight. Voice AI ensures that every call meets disclosure requirements, follows local and federal compliance standards, and logs interactions for auditability.

Unlike human agents who may vary in tone or miss required scripts, Voice AI delivers consistency and reliability, critical in regulated environments.

2. Scalable and Intelligent Outreach

Human agents can only make so many calls a day. Voice AI, on the other hand, operates at scale, engaging thousands of users simultaneously without a drop in quality. More importantly, these aren't robotic, one-size-fits-all messages. This is automated collections for BNPL, but with nuance.

3. Personalized Conversations That Drive Results

Missed payments often happen not out of unwillingness, but confusion, forgetfulness, or poor communication. Voice AI systems can detect intent behind user responses, and probe gently to uncover root causes.

For instance, when a user says, “I can’t pay right now,” AI can ask whether it’s due to job loss, payment method failure, or scheduling issues and route the call accordingly. This level of personalization boosts the chances of a successful resolution while reducing customer frustration.

4. Operational Efficiency and Performance Insights

With Voice AI handling Tier-1 collections and follow-ups, human agents are freed to focus on complex cases where empathy and negotiation are required. AI also provides analytics such as call success rates, common objections, and payment completions, helping teams refine strategies faster than ever before.

This makes Voice AI not just an execution tool, but a strategic intelligence layer for BNPL recovery operations.

Implementing Voice AI in BNPL Collections:

For BNPL providers looking to adopt Voice AI, a structured approach helps ensure impact without disruption:

Step 1: Launch a Pilot in Low-Risk Segments

Start with a focused rollout targeting overdue accounts under 30 days. Use predefined AI workflows to understand what’s working and where fine-tuning is needed.

Step 2: Integrate with Existing Systems

Modern Voice AI platforms come pre-integrated with CRMs, payment gateways, and analytics dashboards. This minimizes development time and ensures a smoother launch.

Step 3: Define Escalation Protocols

Voice AI should not operate in a silo. Define clear rules for when the AI should escalate a call to a human agent. This hybrid model enhances effectiveness and preserves the human touch when it’s needed most.

Step 4: Continuously Train the AI on Real Data

Unlike static scripts, AI improves over time. Use feedback, call transcripts, and customer behavior data to continuously update and improve your AI’s capabilities.

Why Voice AI Matters Now, Not Later

The BNPL sector is approaching an inflection point. As profitability becomes more important than growth-at-all-costs, collections efficiency and portfolio recovery will become make-or-break metrics. Voice AI gives BNPL providers a head start in building resilient, future-proof systems. Those who wait risk falling behind in both customer satisfaction and financial performance.

Every AI-powered call is an investment into a smarter, more adaptive collection strategy. The system learns. It evolves. And over time, it helps build a competitive moat that’s hard to replicate. Early adopters won’t just collect more, they’ll collect better.

Choosing the Right Voice AI Vendor for BNPL Collections

1. Collections-Specific Experience

Generic AI platforms may not understand the intricacies of debt recovery, especially the fast-paced, high-volume nature of BNPL. Look for vendors with. Proven results in high-volume outreach, objection handling, and workflows are a must.

2. Compliance-First Architecture

TCPA, FDCPA, and evolving state regulations aren’t optional. The right vendor should offer built-in compliance logic, audit-ready logs, customizable disclosures, and strict script governance to ensure every call stays within legal boundaries.

3. Intelligent, Human-Like Conversations

Your users expect empathy, not canned scripts. Evaluate whether the voice agents can adapt tone, understand context, and manage objections in a natural, helpful way. Bonus: multilingual capabilities for broader reach.

4. Integrations (and Flexibility to Build More)

To drive real results, Voice AI needs access to your CRM, collections platform, and payment gateways. Choose a provider with pre-built integrations and API flexibility so data flows seamlessly and calls stay relevant and timely. Even more importantly, the right vendor should be open to building custom integrations tailored to your unique workflows, not just offering a one-size-fits-all stack.

The Bottom Line

Voice AI in BNPL collections isn’t a gimmick. It’s an infrastructure upgrade. It replaces disjointed processes with intelligent workflows. It turns compliance from a liability into a strength. And most importantly, it respects the borrower while protecting the business.

As the financial terrain shifts, Voice AI will become a standard, not an edge. The real question is: who’s ready to lead, and who’s willing to wait?

→ Want to see Voice AI in action?

Try speaking to an AI voice agent →

→ Interested in implementing Voice AI? Book a meeting.

Learn more about Voice AI for BNPL Collections here

.jpg)

.png)

%20(4).webp)

.png)

-min.png)